We are facing unprecedented times with Covid-19 which is severely crippling some industries while leaving others relatively intact. Within the electrical construction industry, some businesses are feeling the impact more than others. Some are crushing under the weight of the pandemic while others remain relatively unaffected.

Here is a high-level overview of how 4 different sectors within the construction and electrical industry and how they have been operating during the pandemic.

In the hospital construction sector, the impact has been mixed. Unsurprisingly, there has been a surge of expedited hospital construction which has benefitted electrical contractors working within this sector. For example, Gulf Coast Medical Center fast-tracked its expansion to accommodate an influx of Covid-19 patients.

However, in other cases, with hospitals losing an estimated $50 billion a month, construction projects are not a priority. Some projects have been stalled as hospitals prioritize immediate patient needs and preserve cash flow. For the reasons outlined above, hospital construction has been booming and hurting at the same time; with hospital revenue and priorities being the determining factors.

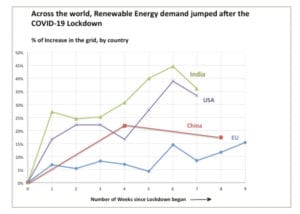

Unlike other sectors of the industry that have been hurt by the pandemic, the renewable energy industry has proven resilient in the face of Covid-19. In the first quarter of 2020, the use of renewable energy globally went up 1.5% compared to the first quarter of 2019. With lockdown measures resulting in reduced electricity demand, the oil and gas industry is experiencing massive losses.

To balance the lower demand, electrical grid operators are opting for the use of alternative cheaper energy which has resulted in a spike in the use of renewable energy.

The commercial construction industry may have been the worst hit of the construction sectors. This could be accounted for by economic uncertainty which has led to either delays or cancellations of projects and also disruptions of the supply chain within the industry.

This has been reflected by a drop in contractors’ confidence in new business opportunities and expectations by 26 points from the first quarter of 2020. The low vote of confidence however is no surprise as the industry recorded a high rate of unemployment with a loss of 975,000 jobs in April.

Learn more about how the impact of Covid-19 on the electrical construction industry may be felt in 2021.

While the commercial industry may have taken the biggest hit during the pandemic, heavy civil construction has been adjusting comparatively well. Data collected from contractors shows over half (56%) of those in the heavy civil industry report high confidence in new business opportunities and the level of backlog.

Exhibiting an appropriate response to the current economic trends, the heavy civil construction sector seems to be incorporating advanced tools and digital processes which could be the reason for its adjustment to the pandemic.

Despite the uncertainty facing the electrical construction industry, there is hope for a strong rebound. Construction activity is said to be returning to pre-coronavirus levels in 34 states.

Having observed the trend of the impact on different construction sectors, it seems apparent that those doing well, (i.e. renewable energy industry and heavy civil construction industry) are adapting to the economic trends.

Given the new normal that Covid-19 is creating not just for the US but the whole global economy, the construction sector will need to be flexible and incorporate changes that will allow it to function, and even thrive in some sub-construction sectors.

Learn more about the possible impact of Covid-19 on electrical construction industry in 2021.