When the United States Geological Survey (USGS) released its Critical Minerals List in 2022, copper was surprisingly missing.

The omission raised more than a few eyebrows. On a list with high-risk minerals like samarium, gallium, and tungsten, as well as less risky ones like aluminum, indium, and zinc, copper seemed like a slam dunk.

At the time, USGS Director David Applegate said copper had made a case for inclusion on the list but missed the mark. He mentioned the reddish metal was vulnerable to supply disruption, but wasn’t highly dependent on imports. Applegate also highlighted that most refined copper imports came from trade-friendly countries, including Chile, Mexico, and Canada.

According to USGS data, from 2020 to 2023, Chile supplied nearly two-thirds (65%) of U.S. refined copper imports. Canada and Mexico made up 17% and 9%, respectively. In total, refined copper comprised nearly 90% of U.S. unmanufactured copper imports.

But why did the USGS suddenly change its stance?

While the USGS’s decision is important, it follows another agency’s action two years ago.

In 2023, the Department of Energy included copper in its Critical Minerals Assessment, citing growing demand and potential supply chain issues. The move received bipartisan support from lawmakers in Washington and from trade and industry groups. For those cheering, the hope was that the DoE’s move would push the USGS to eventually do the same.

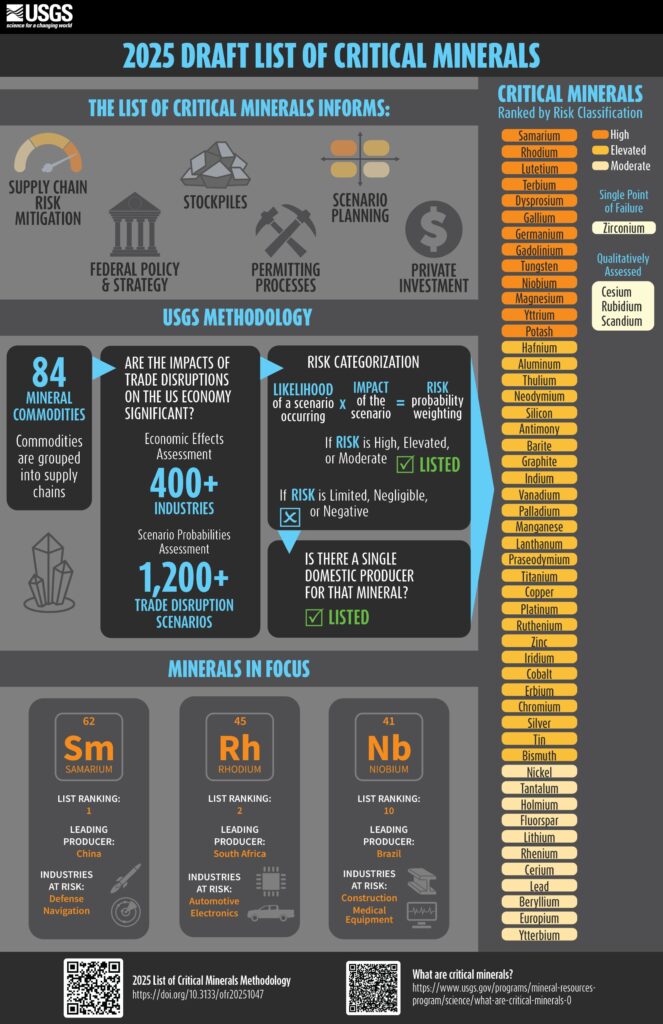

Fast forward to August 2025, and the USGS has made its own move to solidify copper’s role in U.S. growth and security. The agency’s newly compiled list includes 54 critical minerals, like copper, silver, silicon, and lead.

The move is welcome news for private companies, lobbying groups, and government agencies, and could have far-reaching implications. Critical minerals affect everything from federal strategies and stockpiling to permitting and private investment.

Long story short, becoming critical has a massive upside.

The last step in the process will happen soon when the list is published to the Federal Register later this year. But with this next step in place, what happens next, and how does it help companies?

After years of prodding from lobbyists, lawmakers, and economic experts, the USGS is revising its stance on copper.

However, it also poses the question: what makes a mineral critical, and what does it mean for us?

Choosing minerals for the Critical Mineral List requires careful thought. Despite Earth’s thousands of different minerals, only a small percentage are important enough to monitor.

To decide which ones qualify, they must meet several key criteria outlined by the Energy Act of 2020. Under the law, the USGS developed several economic models showing how trade disruptions impact mineral availability.

Using those models, the agency can decide what minerals meet specific standards for inclusion, like:

While these rules apply to hundreds of minerals, fuels like oil, uranium, or coal are excluded from consideration.

From sunup to sundown, seemingly everything we interact with contains copper.

“Think about it—we flip on the lights when we wake up, which use copper to provide constant electricity to our homes,” KrisTech Supply Chain Director Marcus Tagliaferri explained. “Our coffee makers, smartphones, laptops, and even the EV we drive to work all feature copper components. And at its most basic level, copper conductors make up the hundreds of thousands of miles of power lines stretching from sea to shining sea.”

Our need for more electricity also relates to our growing dependence on technology. For nearly two decades, electricity demand remained flat, but new technology is creating massive needs. From electric vehicles and advanced artificial intelligence to a growing number of data centers, power demand is exploding.

Demand isn’t showing any signs of slowing down, either. Data from the U.S. Energy Information Administration highlights a sharp increase in electricity consumption over the next two years.

When the USGS analyzes a mineral’s national impact, one method used is to track it against our Gross Domestic Product (GDP).

As we’ve seen before, disrupting the copper supply chain can cause ripples in commodity pricing and result in millions in lost production. Minerals with annualized probability-weighted net decreases higher than $2 million were recommended for the USGS list. The agency’s draft 2025 Critical Minerals Report showed that copper supply chain issues could result in an annualized probability-weighted net decrease of $56 million in lost GDP.

While it seems like a massive amount of money at first glance, the United States’ GDP is about $29 trillion annually. Of the 54 minerals included in 2025’s list, only about 20 could result in an annualized probability-weighted net decrease of more than $100 million.

Copper’s influence may seem small compared to our overall GDP, but its economic footprint stretches across many industries.

Becoming a critical mineral is more than a title—it’s an avenue for expanded government monitoring and support.

More permitting, mining, and ore processing. Thanks to its delicate supply chain, becoming a critical mineral extends government support for domestic production. As a result, the government is more likely to directly support new mine development and reopen old mines. More mining also means the potential for additional refineries, reducing dependence on imports.

Increased federal funding and tax incentives. Funds through the Department of Energy, Department of Defense, and other agencies support overall mineral development. Additionally, companies can take advantage of tax incentives, including 45X production credits.

More recycling efforts. In 2022, the U.S. recycled an estimated 830,000 tonnes of copper – about 32% of the total supply. Spiking copper needs may pave the way for more innovative recovery and recycling processes.

Critical supply chain support. Global supply chains are delicate, so it makes sense to nurture the right partnerships. To protect our critical mineral supplies, the government may negotiate for better terms or forge relationships with other countries. It may also mean using resources to establish and maintain nearshore or domestic supply chains.

Every mineral and situation is different, so there may be one or more sensible options. However, the goal is always to develop and maintain long-term supply chain resilience.

Copper’s inclusion on the Critical Minerals List is a huge step for the industry and the country. But what does this new emphasis on supply and demand mean for us?

The answer lies in what landed copper on the list—meeting the three requirements outlined by the Energy Act of 2020.

As the United States develops modern supply chains, domestic growth takes center stage.

For Americans, addressing economic and national security means better, high-paying jobs. It means more investment in mine discovery and establishment, creating thousands of positions across the United States. We’re also more likely to see expanded research and technology investments, potentially leading to breakthroughs.

With time, the additional funding and focus on copper mining and refining may lead to increased production. We’d also be more likely to see some stabilization in copper prices with more stable supply chain management tactics.

While KrisTech and other manufacturers worry about copper supplies for wire and cable, we’re not the only ones using it.

You can find copper in many consumer items, electronics, and even medical products, but those applications pale in comparison to its linchpin role in military products. From aircraft parts and defense systems to rockets and detection equipment, the metal is critical to success. Without a steady, high-quality supply, military operations may suffer, leading to national security concerns.

Most importantly, focusing on critical minerals helps us address potential failure points before they occur.

Given its huge array of applications and global consumption, it’s not surprising that copper demand is increasing. But the need goes far beyond expanding a creaky and unreliable electrical grid, affecting renewable energy development, machine learning applications, and consumer goods. Without real-time supply chain development and maintenance, we may struggle to meet ever-rising demand.

Additionally, while roughly one-third of our copper comes from recycled material, it can only do so much. Recycling processes are improving but fall far short of meeting the amount we use annually. The good news is that recycled copper is much purer than mined mineral resources and needs far less refining to use.

To meet demand, America should rethink its approach to sustainable mining. It starts with reopening old mines and scouting and developing new ones. From there, the country may press for additional domestic refining and production capacity, reducing its need for imports. Finally, the country may invest money into innovative recycling processes to promote a circular economy.

No matter how we approach the task, the goal is clear: supplement what we get through the global economy with domestic supply.

Copper may be critical to the USGS now, but industry insiders have known this for years.

New technology, energy sources, and ongoing expansion all rely on a steady supply of copper. Without it, we risk falling behind. Now is the perfect time for the U.S. to jump in and work closely with its global partners. Doing so keeps import lanes and supply lines open while supporting domestic production.

The truth is global competition for critical minerals and resources isn’t slowing down. With the right approach, the United States can thrive today and for years to come.