Let’s start this month’s roundup with a question!

What U.S. state has the most active copper mines?

Want to know the answer? Scroll to the bottom to find out!

Copper prices have been riding a wave for the past few months, ranging from a low of $3.69/lb. in mid-February to more than $4.10 in mid-March.

Prices are beginning to slide below $4, but what’s causing all the turbulence?

One clue to the puzzle might be found in China.

To cope with a raw materials shortage and underperforming plants, top copper smelters in China collectively agreed to cut production during a meeting in Beijing last week.

Though Chinese smelters feel new pressure, other projects are nearing the finish line. Zambia’s Kansanshi mine is expected to be complete in mid-2025. The project entails expanding the mine pit and mining fleet, constructing a new processing plant, and expanding a smelter.

Although construction input prices for materials like copper wire and cable and gypsum products have fallen since last January, global issues will likely keep the cost of some materials elevated.

The latest Israel-Hamas war could affect import prices, availability, and lead times. In addition, many transportation providers are rerouting around the Red Sea and Suez Canal, which has created a surge in ocean shipping rates, adding another price hike to contractors’ books.

As the Red Sea crisis persists into its third month, container shipping lines are encountering significant challenges in managing port congestion and a shortage of vessels.

According to the Office of Naval Intelligence, between December 27, 2023, and January 24, 2024, 16 incidents tied to Houthi rebels occurred in the Red Sea. The attacks are tied to the ongoing Israel-Hamas conflict and have impacted shipping companies, including Maersk. The Danish decided to reroute its ships around the Cape of Good Hope to avoid potential problems.

Concerns about potential dangers have sent ripples through the international shipping community, leaving commercial vessels and other ships in the Red Sea trying to avoid dangerous situations.

In the face of continued threats, what are companies doing to lessen the blow?

Construction input costs are up 38.7% compared to February 2020, according to an Associated Builders and Contractors analysis of Bureau of Labor Statistics data.

Prices of unprocessed energy materials, natural gas, iron and steel have risen more than 50%.

The Port of Savannah processed 422,287 total TEUs (Twenty-Foot Equivalent Units), a 4% fall year over year, while the Port of Brunswick had a record year for auto units. The next few years could bring further disruptions to a freight model the industry spent decades optimizing.

Meanwhile, the subindex for transportation prices (57.6) increased 1.8 percentage points sequentially in February. The index has been in contraction territory since July 2022.

In a recent packaging survey, 82% of those surveyed said they have used connected packaging, compared to over four-fifths (81%) from the survey released in 2023 and over half (54%) in 2022.

Packaging optimization benefits ripple across the entire supply chain, from streamlined operations to enhanced brand reputation in an environmentally conscious market. Here are some of its specific advantages and goals.

The U.S. had a 2023 third-quarter net import of recycled plastics material equivalent to $15.6 million, up 5.2% from the third quarter of 2022. Additionally, 1.1 billion pounds of vinyl was recycled last year, a 17% rise over 2019.

Orbia, a prominent PVC giant based in Mexico, has announced the indefinite suspension of its ambitious project to construct a Polyvinyl Chloride (PVC) manufacturing facility along the U.S. Gulf coast.

GCC PET (Polyethylene Terephthalate) market demand is forecasted to grow at a CAGR (Compound Annual Growth Rate) of 5.30% over the projected period of 2024-2029. GCC PET supply is expected to reach 3.61 million tons by 2029, while GCC PET demand in 2023 stood at 2.20 million tons.

During the first half of February 2024, there was a significant increase in the prices of Linear Low-Density Polyethylene (LLDPE) saw both in Europe and the United States. This escalation predominantly stemmed from supply shortages and heightened market demand.

When American Rare Earths, an Australian company, found a massive cache of rare earth elements (REEs) in Wyoming, it sent shockwaves through the industry.

Rare earth elements are all around us. From smartphones and laptops to military tech, batteries, and solar panels, they power seemingly everything in our world.

The U.S. is pushing toward 100% pollution-free power by 2035, making wind, solar, and other renewable energy more vital than ever. REEs are our key to a cleaner world.

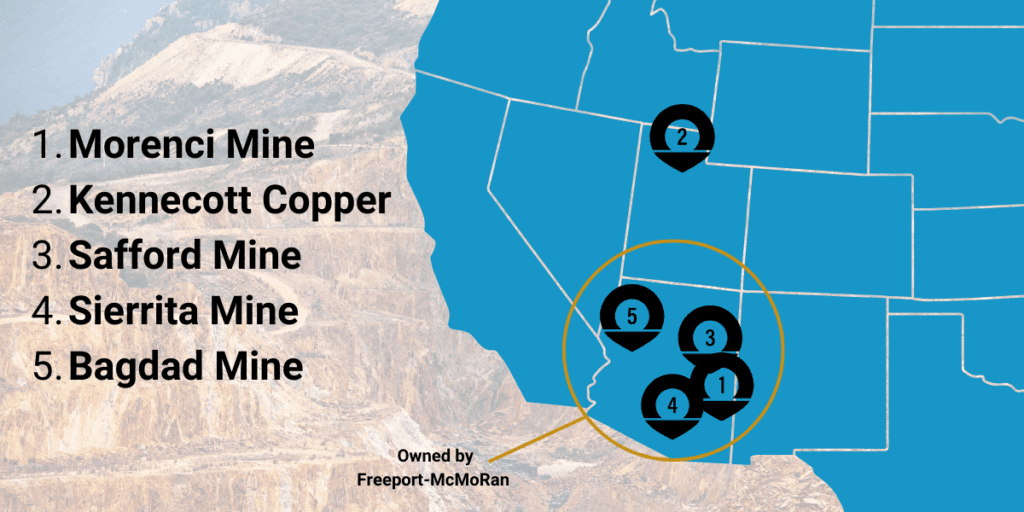

Copper is a cornerstone of Arizona’s history and economy. Since 1910, the state has been the nation’s leading copper producer. Today, 68% of all the copper produced in the U.S. comes from Arizona.

During 2020-2021, Freeport-McMoRan’s output was up by 20%.

Get information like this and SO MUCH MORE through our dynamic industry newsletters curated just for you.

No fluff, no sales pitches, just the best information we can find to keep you up-to-date and in the know. From chasing down the latest clean energy innovations and staying up to date on copper updates, think of us as a content buffet.

Click here to unlock a world of information with Kris-Tech!